The European Union’s Carbon Border Adjustment Mechanism: Challenges and Prospects for the Agricultural Sector – Analysis n°207

Partager la page

The Analysis notes present in four pages the essential reflections on a current subject falling within the areas of intervention of the Ministry of Agriculture and Food Sovereignty. Depending on the numbers, they favor a prospective, strategic or evaluative approach.

A Carbon Border Adjustment Mechanism (CBAM) has been adopted by the European Union (EU) in 2023, with full entry into force on the 1st January 2026. It covers five sectors or products, including nitrogen fertilisers. The CBAM should enable European companies in these sectors to continue to decarbonise, while protecting them from competition and limiting carbon leakage. However, it could also lead to a loss of competitiveness for European exports, affecting fertiliser producers but also agricultural products and downstream industries. This note analyses the implications of the implementation of the CBAM. Three illustrative prospective scenarios outline a broader extension of the mechanism to agriculture.

Introduction

A European Carbon Border Adjustment Mechanism (CBAM) was adopted in May 2023.1 Part of the Fit for 55 package, its aim is to support the EU's decarbonisation efforts, in particular by reducing carbon leakage, while protecting European businesses from the competition of imported products with higher greenhouse gas (GHG) emissions. Agriculture is affected by this scheme because nitrogen fertilisers, of which Europe is a major importer, are among the covered sectors. Over their entire life cycle, nitrogen fertilisers emit two GHGs: carbon dioxide (CO2) and nitrous oxide (N2O). They are therefore responsible for around 2.1% of global GHG emissions, all sectors combined.

This note looks at the consequences of the introduction of this pricing mechanism for imported emissions. The first part looks at the emergence and functioning of the CBAM. It is followed by an analysis of the consequences for the European agricultural sector of the inclusion of fertilisers in the mechanism. Finally, the third, forward-looking section presents three scenarios for a future wider extension of the CBAM to agriculture.

The CBAM: Emergence and Functioning of a Pricing System for Imported Emissions in the EU

A Mechanism Designed to Prevent Carbon Leakage

In Europe, GHG emissions from installations in the highest-emitting industrial sectors are covered by the Emissions Trading Scheme (ETS). These companies face competition from third countries’ imports, which are often subject to less stringent environmental regulations and lower carbon prices (e.g. around 9 US dollars (USD)/tCO2 in China compared with 90 USD/tCO2 in the EU in 2023). Academic studies suggest that 10% to 25% of the GHG emissions avoided thanks to a carbon pricing system could be cancelled out by "carbon leakage", i.e. the relocation of emitting activities to other countries with less restrictive policies.2 The CBAM was introduced to limit such leakage by subjecting imports to the same pricing as that applied to European companies.

The CBAM's objective is therefore threefold. Firstly, it aims to support European climate policies by preventing the displacement of emissions through the replacement of domestic production by imports of emission-intensive products. Secondly, it aims to preserve the competitiveness of EU businesses by protecting them from the harmful effects of a unilateral carbon pricing policy (e.g. relocation, unfair competition). Finally, the CBAM pursues a normative logic and encourages third countries to adopt more ambitious climate policies in order to preserve their access to the European market. The EU is thus using the CBAM as a diplomatic tool based on the "Brussels effect "3, i.e. the idea that by regulating its own market, it can export its standards to the rest of the world.

The Outcome of a long Process

The CBAM had already been the subject of legislative proposals in 2007, 2009 and 2016. Drawing lessons from these three failures, the technical difficulties of the mechanism (compatibility with World Trade Organisation (WTO) rules4, carbon calculation, etc.)5 have recently been overcome. More generally, the re-emergence of the CBAM since 2019 has several causes.

Firstly, climate concerns have become the new global frame of reference in public policies. The EU's ambition has increased since the 2019 European elections, as has the commitment to climate neutrality by 2050. The CBAM has emerged as a necessary tool for achieving these objectives, and as a legitimate instrument of EU climate diplomacy in front of the heterogeneous ambitions of third countries (e.g. the withdrawal of the United States from the Paris Agreement in 2017).

As the shortcomings of the ETS became more apparent6, they also encouraged the emergence of the CBAM. It was decided that the free emissions allowances initially allocated to European companies would progressively be phased out, and that an alternative would be found to maintain the competitiveness of EU companies facing the rising price of a tonne of CO2. Carbon leakage was identified as an issue to be fully addressed, in a context where the notion of "strategic autonomy" advocated for the protection and relocation of European industry.

Finally, the introduction of an instrument that had long been considered protectionist has become less sensitive in recent years due to the deterioration in trade relations and the rise of international protectionism (e.g. Brexit, trade wars, etc.). Fears of unfair competition have taken precedence over concerns about retaliatory measures being imposed, including for highly exporting countries such as Germany.7

These factors, together with France’s determined action, which was very supportive of the CBAM, created a window of opportunity in 2019, that enabled the scheme to be put on the agenda and then adopted.

Functioning of the System

A complementary tool to the ETS, designed to replace free emissions allowances, the CBAM subjects certain goods imported into the EU to carbon pricing in order to put them on an equal footing with European products. Six sectors are concerned: nitrogen fertilisers, iron and steel, aluminium, cement, electricity and hydrogen.

Importers of these products will have to purchase "carbon certificates" from a European authority. The number of certificates to be purchased will be determined according to the GHG emissions (direct and indirect) linked to the production of the goods, calculated on the basis of information supplied by the exporter. The price of these certificates will be linked to that of the EU ETS. Carbon pricing systems in third countries will be taken into account, allowing importers to deduct the amount already paid in the country of origin from the CBAM "carbon certificate". Difficulties could arise in collecting, monitoring, accounting for and tracing emissions, given the diversity of calculation methods and the heterogeneity of existing pricing systems.8 A transition period is planned until the end of 2025, during which importers will only be required to report emissions, with no associated financial obligations (Figure 1).

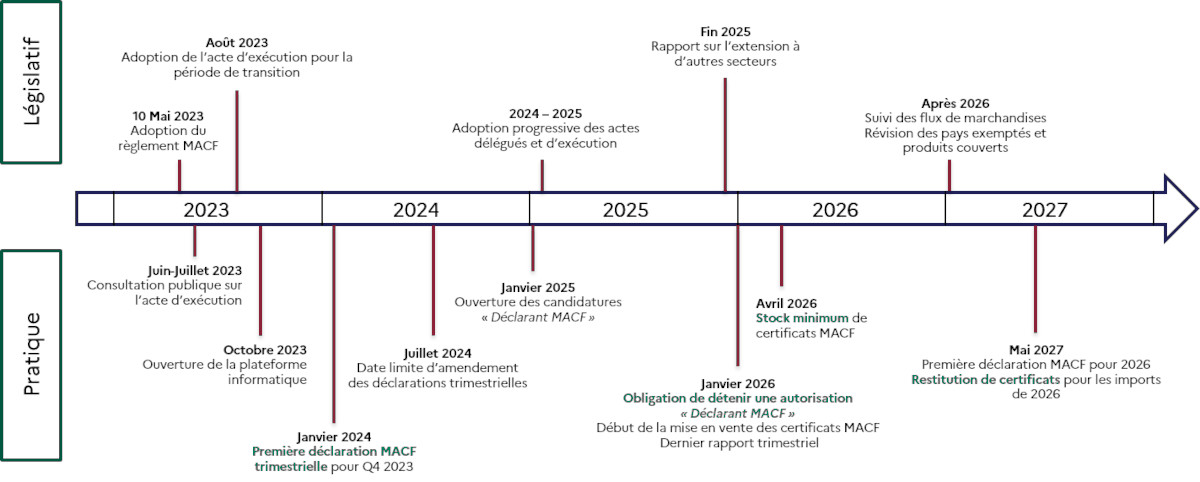

Figure 1. Provisional timetable of the CBAM’s implementation

A timeline shows the projected timetable for implementing the Carbon Border Adjustment Mechanism (CBAM), from the adoption of the CBAM Regulation in May 2023 to the end of 2027, when the first CBAM evaluation report should be produced and the monitoring of goods flows should take place.

Source: Ministry of the energy transition, 2024, The carbon border adjustment mechanism. Practical importer’s guide.

At the same time, the free emissions allowances allocated to European producers will be phased out progressively until 2034, eventually forcing them to pay for all their emissions and encouraging them to decarbonise their production. The revenue generated by this system, estimated at between €9 billion and €17 billion a year by 2030, will be added to the EU budget's own funds.

Inclusion of Nitrogen Fertilisers in the CBAM: What Challenges for European Agriculture ?

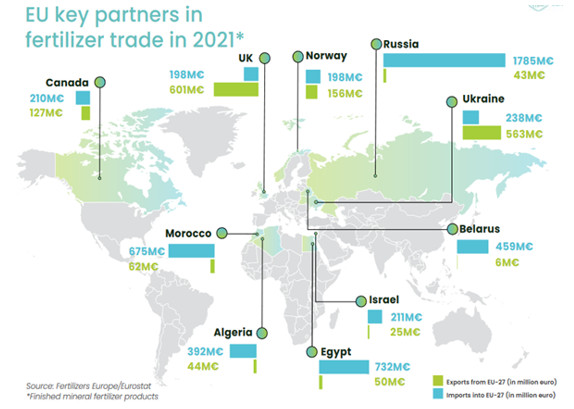

The CBAM affects the agricultural sector because it concerns nitrogen fertilisers (10 Mt/year consumed in the EU), but also the electricity (indirect emissions) and, potentially, the hydrogen used in their production. It includes five categories of GHG-emitting fertilisers: nitric acid, ammonia, potassium nitrate, mineral or chemical nitrogen fertilisers and compound fertilisers. The EU is heavily dependent on fertiliser imports: in 2021, 30% of its nitrogen consumption was imported.9 These imports come mainly from Russia, Belarus, Egypt and Morocco, all fertilisers combined (Figure 2).10 France, the world's 8th largest user, accounts for 4% of global nitrogen fertiliser imports.

Figure 2. The EU's main trading partners for fertilisers in the form of finished products in 2021

A planisphere shows the European Union's (EU) main trading partners for fertilisers in the form of finished products in 2021. The map shows that the main countries importing fertilisers into the EU in 2021 were Russia, Egypt, Morocco, Belarus and Algeria. Conversely, European fertiliser exports were mainly destined for the United Kingdom and Ukraine in 2021.

Source: Fertilizers Europe

The EU also has a domestic fertiliser production industry, spread over 120 sites, which generated an average of 40.2 Mt of products per year from 2019 to 2021. Around a third of this production is destined for export. In 2021, the EU accounted for 9% of global nitrogen fertiliser production.11 The industry remains fragile because of its heavy dependence on natural gas (80% imported) which is used for production.

What are the Prospects for European Fertiliser Producers and Third Countries ?

With the increase in the relative price of imports, due to the cost of acquiring carbon certificates (the price of which is expected to increase by more than 10% between now and 2040), imports should fall. Domestic demand should then be satisfied by a greater proportion of European products through a substitution effect. As the European fertiliser industry already emits less than non-EU countries, the CBAM should lead to an overall reduction in emissions and should support European production, which would be protected from external competition. The mechanism should significantly reduce carbon leakage from the EU, more than the current system of free allowances (between -34% and -42%, all sectors combined, according to academic research12).

European production should also continue to decarbonise, due to the abolition of free allowances and the price signal from the ETS. The price of carbon could rise to €160/t by 2030.13 Fertilisers based on green ammonia, produced from hydrogen derived from decarbonised energy, are expected to gradually become profitable and mass-produced. However, the European industry could lose competitiveness on the export market as a result of higher production costs. Additional carbon emissions could occur on third markets as a consequence, where European low-carbon fertilisers would be replaced by non-European fertilisers with higher emissions and lower prices, as they would not be subject to the same carbon price.

The CBAM is likely to result in a loss of competitiveness for the EU's trading partners, who could refer the matter to the WTO Dispute Settlement Body or impose customs duties on European fertilisers in return.14 The BRICS have already expressed their concerns in a joint declaration, in 2021, while "developing countries" will find it difficult to adapt to the constraints associated with the CBAM, due to their less mature, higher-emitting industries.

Conversely, countries that already have emissions pricing systems should be less affected. Some have already launched consultations or draft national CBAM projects (United States, United Kingdom, India, etc.) and are investing in green ammonia to decarbonise their industries (e.g. China, Australia). However, third countries could circumvent the CBAM by setting up a low-carbon supply chain for the European market, which would coexist with a carbon-intensive supply chain for the rest of the world (‘resource shuffling’). The choice of the method for calculating emissions and verifying declarations, the introduction of an anti-fraud system and support for third countries to increase their skills, are all parameters that need to be considered in order to limit these harmful effects.

Impacts on the Farming and Agri-food Sectors

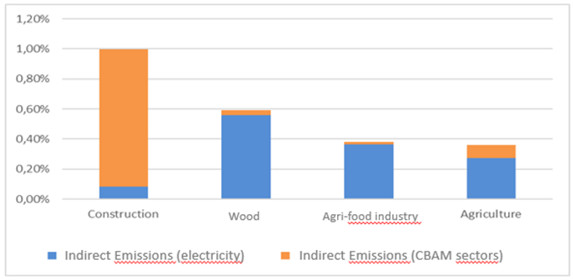

In the absence of changes to farming practices, the CBAM would probably have a negative impact on the competitiveness of the farming and agri-food sectors. They could be affected indirectly by up to 0.36% and 0.38% of their added value respectively, due to the use of fertilisers in their production processes, but also of electricity (indirect emissions) (Figure 3).15 Fertilisers account for between 6% and 12% of agricultural input costs. The rise in fertiliser prices is therefore likely to impact European farmers' margins for certain crops and/or be passed on along the value chain (to processors, distributors, consumers). Carbon leakage could shift from fertiliser production to the agricultural and agri-food products that use them, and which are not subject to the CBAM, via an increase in their price. These products will then face competition from imported goods produced with more carbon-intensive fertilisers. Outside the EU, there is a risk that European agricultural products will be replaced by more carbon-intensive but cheaper goods from third countries. Taking all products together (including non-agricultural products), European exports of intermediate goods are expected to fall in volume by -8.6% and exports of finished products by -6% between now and 2040, while the impact on EU GDP is expected to be only -1.3%.

Figure 3. CBAM exposure of downstream sectors

This bar chart represents the exposure to the CBAM of downstream sectors (agriculture, agri-food, construction and timber) indirectly impacted by the mechanism. The carbon intensity of each of these sectors is expressed as a percentage of their gross value added, which defines the height of the bars. For each sector, a distinction is made between indirect emissions linked to the production of electricity used in production processes, and indirect emissions linked to the use, by the sector concerned, of a product subject to the CBAM.

Source: graph based on data from the report of France Stratégie, The economic implications of climate action

Reading: the graph shows the carbon intensity of certain downstream sectors, expressed as a percentage of their gross value added. Agriculture and the agri-food industry could be impacted by the CBAM, mainly because of indirect emissions linked to the production of electricity used in production processes (scope 2, blue) and, to a lesser extent, because of indirect emissions linked to the use of fertilisers (scope 3, orange). Other sectors are more affected by the indirect emissions of the sectors covered by the CBAM (e.g. cement for the construction sector).

However, the price signal from the ETS and the roll-out of environmental policies (Farm to Fork Strategy, etc.) should also encourage farmers to reduce or optimise their use of fertilisers. Low-carbon fertilisation methods (e.g. organic fertilisers) and certain production methods and techniques (e.g. organic farming, conservation farming, agroecology) could be encouraged. In particular, crop choices could be modified, with those requiring lower nitrogen inputs becoming more economically attractive (e.g. substituting legumes for cereals). These long-term trends also depend on other factors, such as levels of public support, the structuring of agricultural sectors and consumption patterns.

Scenarios for Extending the CBAM to the Agricultural Sector

At the European level, a pricing system for agricultural emissions based on an emissions trading scheme (AgETS) is already under discussion. A recent study commissioned by the European Commission explores five AgETS options16: at farm level (for all emissions, those from livestock only, or those linked to the agricultural use of drained peatlands); for upstream companies (fertiliser and animal feed producers); for downstream companies (meat and dairy product processors). At a price of €100/tCO2eq, an AgETS covering all agricultural emissions would enable EU agricultural emissions to be reduced by 23.4% by 2030, compared with a reference scenario based solely on current policies.17 Half of these reductions would come from changes in production. Bovine meat would be the most affected, with an 8.2% increase in prices and a 4.4% reduction in consumption. The overall economic impact would however be small for consumers.

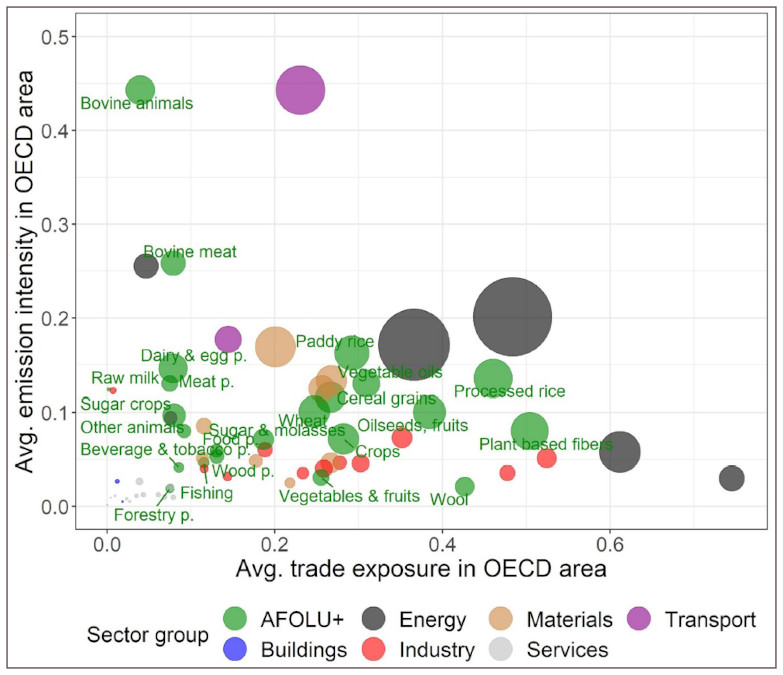

Adopting an AgETS would create a risk of carbon leakage. Current thinking on this subject therefore suggests that the CBAM could also be extended to agricultural products. The sectors most exposed to carbon leakage would be beef, rice, plant-based fibres, cereals, wheat and vegetable oils (Figure 4).18 The CBAM regulation itself provides for the possibility of such an extension, and certain agricultural products are already listed as exposed to the risk of carbon leakage (e.g. sugar, malt, potatoes, etc.).19 The current system (which only covers 2.3% of total EU imports) can be seen as a "trial balloon", aimed at gaining acceptance for the idea of this public policy instrument, with a view to deploying it more widely in the future.

Figure 4. GHG emissions intensity and exposure to international trade of agricultural products in countries of the Organisation for Economic Cooperation and Development (OECD)

This graph represents, for various agricultural and non-agricultural products, the intensity of greenhouse gas emissions (y-axis) and their exposure to international trade within OECD countries (x-axis). The graph considers a scenario where greenhouse gas emission pricing is applied to both direct emissions linked to production, and to indirect emissions linked to inputs.

Reading: the graph shows the GHG emission intensity of products (y-axis) and their exposure to international trade (x-axis), in a scenario where an emissions tax is applied to both direct emissions linked to agricultural production and indirect emissions linked to inputs. The agricultural products (‘AFOLU+’ in green on the graph) that are the most emissions-intensive and the most exposed to trade would be the most affected by carbon leakage.

An AgETS with an extended CBAM would create new challenges.20 Calculating the carbon footprint of agri-food products will be more difficult than for fertilisers, due to the complexity of supply chains and the monitoring of certain processes (e.g. enteric fermentation in ruminants). For example, a beef steak would require information on farming practices, cattle feed, the age at which it was slaughtered, etc. As for processed products (e.g. pizzas), data would have to be collected on emissions from the entire production process, and therefore often from several countries.21 The diversity of methods for calculating emissions between countries and the possible lack of transparency, would make this monitoring complex.

In the longer term, possible developments remain very much open-ended, against a backdrop of great economic and geopolitical uncertainty. Contrasting scenarios can help illustrate the major potential dynamics (see box).

Box. 3 Scenarios to 2050

The scenarios proposed here imagine a future, from 2030 onwards, with the introduction of an AgETS covering all agricultural emissions, the extension of the CBAM to agricultural and agri-food products, and their consequences by 2050. These illustrative and hypothetical narratives explore different probable futures and present voluntarily contrasting trajectories. They do not claim to describe reality in advance, but are an invitation to projection and reflection. Based on bibliographical resources and interviews with experts, they extend the observations and trends mentioned above.

-

Following trade and political tensions in the early 2030s, non-EU countries adopt pricing mechanisms for agricultural emissions equivalent to the AgETS, in order to continue trading with the EU. However, rising costs are being contested along value chains.

Against this backdrop, the EU extends the CBAM transition period and undertakes to redirect part of the revenue towards the transition of "developing countries". The negotiations lead to the establishment of an international research and innovation (R&I) consortium, with the aim of developing technologies for decarbonising agriculture and making them accessible. Its emergence has been stimulated by the occurrence, in 2032, of an El Niño episode with a major impact on global food security, making the decarbonisation of agriculture a priority.

In 2040, R&I efforts have led to the development of a feed additive that greatly reduces methane emissions from ruminants. At the same time, the massive development of renewable energies and green hydrogen is being encouraged by the launch on the market of powerful batteries, enabling the decarbonisation of farm machinery and fertiliser production.

The CBAM, by exerting pressure on the EU's trading partners, has made it possible to stimulate unprecedented R&I efforts and to achieve the almost total decarbonisation of global agriculture by 2050. France, with its weight in European agriculture and the performance of its research teams, has made a major contribution to R&I efforts and has consolidated its position as an agricultural powerhouse.

-

By 2030, the EU's trading partners are denouncing the CBAM, which they see as a form of environmental imperialism. From 2032 onwards, an alliance between countries in the global South, led by the BRICS, creates new trade routes towards which agricultural flows are redirected, increasingly bypassing the EU.

Within the EU, despite an initial increase in production costs linked to the adoption of AgETS, the agricultural sector is making its low-carbon transition, applying the green agenda and gradually becoming competitive. The move upmarket is supported by the CAP, whose environmental instruments have been strengthened. From 2025, the "Strategy for sustainable and healthy food" accelerates the greening of diets, supported by the success of the "Civil COP Z" campaign for sustainable food. This international network of "generation Z" climate activists displays holograms of influencers in supermarkets, presenting the nutritional and climate recommendations associated with certain products.

In 2045, a pandemic slows down international trade and boosts demand for local products. This crisis reinforces the low-carbon local agriculture that the EU has been developing for over 20 years. However, the fall in yields induced by its agricultural model makes Europe vulnerable to the worsening effects of climate change, which have intensified due to the relative inactivity of the rest of the world in terms of mitigation.

In 2050, the EU looks like a "green fortress", with low-carbon agricultural production tending towards self-sufficiency, but surrounded by countries that it has not been able to convince to decarbonise. Production in France, Europe's leading agricultural power, has become central to the EU's food security.

-

Diplomatic and trade relations deteriorate between the EU and its partners, who respond to the CBAM in 2032 by imposing taxes on European agricultural exports. Denouncing a protectionist measure, a growing number of countries take the matter to the WTO Dispute Settlement Body.

Within Europe, a movement of farmers opposed to the AgETS and retaliatory measures begins to grow from 2035, while the EU's trade balance deteriorates. The population, increasingly confronted with insecurity and inequality, joins the movement in the face of rising prices. As the EU moves ever further away from carbon neutrality, climate crises are multiplying, affecting yields and driving up prices. These dynamics are fuelling the rise of political parties advocating the abandonment of environmental standards in the agricultural sector.

Governments initially remain firm and refuse to abandon the AgETS and the CBAM, insisting on their long-term benefits. However, by 2040, faced with protests from the farming sector and European citizens, a worsening trade balance, risks to food security and geopolitical tensions, EU leaders finally make the system more flexible. This decision is encouraged by growing speculation on the AgETS carbon market, which made the system ineffective. Carbon-intensive imports are flooding back into the European market, and the CBAM is eventually abandoned in 2050, having been emptied of its substance.

The system for decarbonising agriculture, based essentially on market-based mechanisms, has not been able to initiate a global transition in food systems, particularly in the face of social protest. In France, where global warming is expected to exceed that of the rest of the world by 2050, the agricultural sector is particularly hard hit, and adaptation policies remain very insufficient.

Conclusion

The CBAM should make it possible to reduce the EU's carbon leakage, by protecting European fertiliser production from competition from imports of more carbon-intensive products, while promoting its decarbonisation via the ETS. It could help achieve the EU’s climate objectives, but could potentially have a negative impact on the competitiveness of the agricultural and agri-food sectors, and on exports. French agriculture, as Europe's main importer and consumer of nitrogen fertilisers, is likely to be particularly hard hit. Extending the scope of the CBAM downstream would, however, reduce this loss of competitiveness, and future revisions of the mechanism should avert this risk. The effectiveness of the mechanism will also depend on the ability to prevent third countries from circumventing it, through strict verification of declarations and alert mechanisms. The CBAM demonstrates the difficulty of combining the defence of climate standards, integration into a globalised trading system and the quest for food sovereignty.

By adopting the CBAM and considering the creation of an agricultural carbon market, the EU seems to be confirming its decision to base its decarbonisation strategy on market-based instruments and emissions pricing, rather than on a strategy of government subsidies, such as the Inflation Reduction Act in the United States. This strategy could be supplemented by regulatory tools (carbon labelling, etc.) and by subsidies to support investment in low-carbon production methods and technologies. The question of how to share the cost of decarbonisation and the social acceptability of a system based essentially on emissions pricing will be crucial in the coming years.

Marie Martinez

Centre for Studies and Foresight

Notes

1 - Regulation (EU) 2023/956 of the European Parliament and of the Council of 10 May 2023 establishing a carbon border adjustment mechanism.

2 - Morsdörf G., 2022, “A simple fix for carbon leakage? Assessing the environmental effectiveness”, Energy Policy, Vol.161/112596.

3 - Bradford A., 2020, The Brussels Effect: How the European Union Rules the World, Oxford University Press.

4 - Bellora C., Fontagné L., 2022, EU in search of a WTO-compatible Carbon Border Adjustment Mechanism, Available at SSRN 4168049.

5 - Mehling M., et al., 2019, “What European carbon border tax might look like”, Vox Column.

6 - European Court of Auditors, 2020, Special Report 18/2020: The EU’s Emissions Trading System: free allocation of allowances needed better targeting.

7 - Van Asselt H., Brewer T., 2010, “Addressing Competitiveness and Leakage Concerns in Climate Policy: An Analysis of Border Adjustment Measures in the US and the EU”, Energy Policy.

8 - Trotignon R., Redoules O., 2023, L’architecture de l’ajustement carbone aux frontières menace l’objectif de réindustrialisation, Rexecode.

9 - Communication from the European Commission of 9 November 2022, Ensuring availability and affordability of fertilisers.

10 - Fertilizers Europe, Facts & Figures 2022.

11 - In terms of world production, France ranks 42nd.

12 - Bellora C., Fontagné L., 2023, “EU in search of a Carbon Border Adjustment Mechanism”, Energy Economics.

13 - Pahle M., Sitarz J., Osorio, S. and Görlach, B., 2022, The EU-ETS price through 2030 and beyond: A closer look at drivers, models and assumptions, Kopernikus-Projekt Ariadne Potsdam (PIK).

14 - Kirkegaard J.F., 2023, Russia’s invasion of Ukraine has cemented the European Union’s commitment to carbon pricing, Peterson Institute for International Economics Policy Brief.

15 - Pisani-Ferry J. Mahfouz S., 2023, The economic implications of climate action, France Stratégie.

16 - Bognar J., Lam L., Forestier O. et al., 2023, Pricing agricultural emissions and rewarding climate action in the agri-food value chain, Publications Office of the European Union.

17 - Stepanyan D. et al., 2023, Impacts of national vs European carbon pricing on agriculture, Environ. Res. Lett.

18 - Spiegel A. et al. 2024, Climate Change Mitigation in Agriculture beyond 2030: Options for Carbon Pricing and Carbon Border Adjustment Mechanisms, EuroChoices.

19 - European Commission, 2019, Delegated decision (UE) 2019/708 concerning the determination of sectors and subsectors deemed at risk of carbon leakage for the period 2021 to 2030.

20 - Nordin I. et al., 2019, “Impact of Border Carbon Adjustments on Agricultural Emissions. Can Tariffs Reduce Carbon Leakage?”, EAAE Seminar “Agricultural policy for the environment or environmental policy for agriculture? “, Brussels.

21 - Matthews A., 2022, Trade policy approaches to avoid carbon leakage in the agri-food sector, The Left in the European Parliament, Brussels.